Midterm elections don’t usually draw much attention and the voter turnout rate tends to be low. But this time is different. Voter turnout for the 2018 midterm elections reached new highs: an estimated 113 million voters cast ballots, making this year the first midterm to exceed 100 million votes. With many controversial policies implemented by the Oval Office, the 2018 midterm elections were widely treated as a referendum of Trumpism. We have already seen the Democrats win the 218 seats needed for controlling the House while the Republicans retained their majority in the Senate. Through this article, we attempt to explain the importance of US Midterm Election and discuss the implication of the result to US economy and Trump’s policies.

Divided Congress: In line with Expectations

Democrats has already gained more than the 218 seats they needed to be the majority of the House, the first time they have gained the control in the past 8 years. Republicans, on the other hand, have seized more seats in Senate by winning Indiana, Missouri and North Dakota from the Democrats. The Democrats have only got one Senate seat in Nevada from Republicans.

Source: BBC news

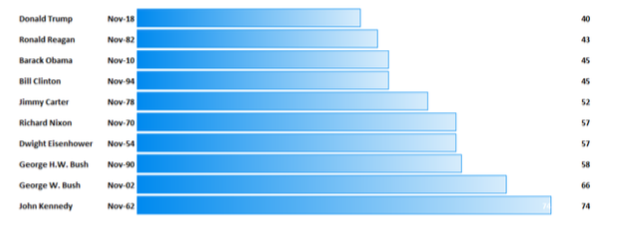

A divided Congress is exactly what people expected. Republicans had all the advantages in the Senate race as 10 Democrat incumbents up for re-election were in states that Donald Trump won in 2016. On the other hand, few thought the Republicans had much of a chance of holding onto the House of Representatives. Historical record shows that the party of the incumbent Presidents would typically lose seats in the midterm election, with only three exception in the past 21 races. President Trump’s low approval rate comparing with other elected presidents didn’t add to the chances for Republicans to keep the House.

Comparison of Approval Rate of Incumbent Presidents in November of Second Year

Source: FinEX Asia Research, Gallup

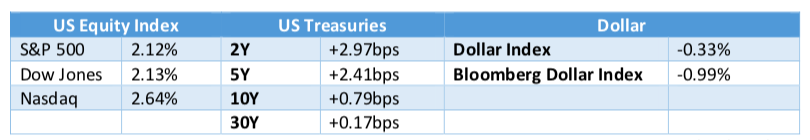

The market reacted mildly positive post-election. In equity market, Dow Jones Industrial Index and S&P 500 was up 2.1%, and Nasdaq was up 2.6%. Treasury yields moved up, while short-end increased more than long-end leaving the curve flatter. Dollar index slightly moved down.

Post-election Market Reaction (Nov 7th)

Source: FinEX Asia Research, Bloomberg

What are the implications of a divided Congress to the US-China trade relations?

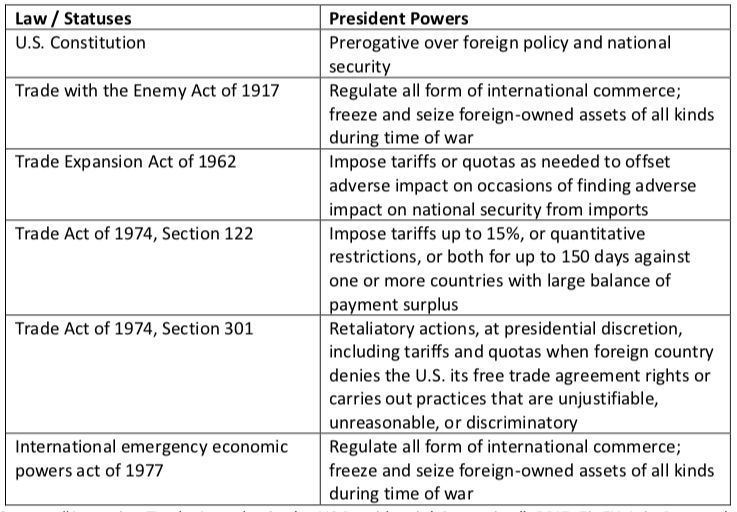

A divided Congress would create significant difficulties for President Trump to accomplish domestic agendas, but not so much for his ambitions on pushing hard on trade policies with China. Reasons are as following:

1. U.S. presidents enjoy executive power on trade policies and the House controlled by Democrats could not stop much even if they try. The constitutional law and various statutes enacted by Congress over the past century authorize the president to impose tariffs or quotas on imports and regulate foreign commerce in other ways. The unilateral actions taken by Trump could be justified by U.S. Constitution, Trade Act of 1974, and Trade Expansion Act of 1962, etc.

Presidential Power on Trade Policies

Source: “Assessing Trade Agendas in the US Presidential Campaign”, PPIE, FinEX Asia Research

2. Democrats are likely to support a tougher stance on Chinese trade and intellectual property practices as well.With Trump taking a hard stance with China on trade, some might falsely believe that the situation would turn better now with “less aggressive” Democrats in the House. But don’t forget, Democrats comparing to Republicans are more supportive to labour unions and less in favour of unconstrained free trade than Republicans. They broadly agree that the U.S. should take tougher action against the rising power across a range of front including trade, intelligence, military and diplomacy. Tough stance on China is probably one of the few areas where there is some bipartisan consensus.

Because of above two reasons, Trump very possibly won’t need to divert from his agendas against China on trade. Unfortunately, as his power on domestic affairs are weakened, he might push harder on China in order to make achievements in the next two years.

What are the implications of a divided Congress to the U.S. Economy?

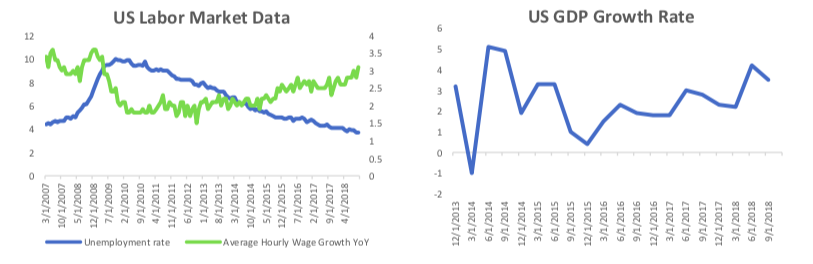

The economic data of U.S. has been quite strong since President Trump took over, especially compared with the lacklustre situation elsewhere, such as the EU, UK, China, and Japan. The QoQ GDP growth of U.S is 4% and 3.5% in the last two quarters. The labour market is in good shape . The unemployment rate has been below 4% since March 2018 and now sitting at 30-year low level of 3.7%. The growth rate of average hourly wages is climbing up to 3.1% yoy, highest in this round of recovery cycle. The U.S economy appears to be healthy. However, what we have seen in the data is, at least partially attributed to the fiscal boost, namely the tax reform implemented by Trump at the end of 2017. Therefore, we think the impact of a divided Congress to US economy is largely coming from its influence on the fate of the next tax cut.

Source: FinEX Asia Research, Bloomberg

Before the elections, Trump has repeatedly advocate that a second tax cut for American middle-class people would be implemented in his term. However, now with Democrats dominates the House, the tax reform 2.0 becomes impossibleeven if it wasn’t just a political gimmick Trump played to for midterm elections.

A new tax bill will fall into the jurisdiction of legislative branches which is Congress. A tax bill will only be effective if it can pass both the Senate and the House, which was the case for tax cut 1.0 when both upper and lower chambers of Congress was controlled by the GOP. A split Congress will significantly tapered Trump’s impact on passing domestic bills.

Last tax cut is estimated by Joint Committee of Taxation to enlarge fiscal deficit by 1 trillion. Without further tax cut and with scrutiny of the opponent party, the fiscal budget could possibly become more sustainable. The market generally reacts well when there isn’t additional fiscal burden on the current government deficit. However, there is arguably concerns about the potential loss of the economy growth momentum due to the interruption of loose fiscal policy. The Congressional Budget Office has estimated that the U.S. deficit would widen up to 4.6% of GDP in 2019 at a time when the economy is expected to show strength.

Is Impeachment of the President Possible?

This potential concern may draw political uncertainly to the current government. Investigations into the President Trump’s finance and presidential campaign activities will continue and likely to increase now with Democrats gain majority in the House. The opponent party will use their power to call hearings and issue subpoenas, but we think it is very unlikely for it to escalate to impeachment – temptation to remove Trump from his position before his term ends.

The most important reason for us to believe the Democrats will not do that is because it would take half of the House and two-thirds of the Senate to remove Trump from office. Even if the Democrats could gather almost every vote controlled by the party in the House, their efforts would go in vein if they could not get 2/3 of the votes from the Senate controlled by the GOP.

Leading Democrats clearly understand the political rationale behind this and would rather use energies for preparing 2020 elections. Steny Hoyer, Nancy Pelosi, Joe Biden, and Adam Schiff, have all been saying that they are not eager to impeach President Donald Trump. Even though there are quite a few activists among Democrat, the party seems to prefer spending time on preparing 2020 presidential election instead of stepping on a road leading to nowhere.

If you are interested in understanding more about trade wars, you may also find both “ As trade war intensifies, watch out for inflation” and “As trade war intensifies, watch out for inflation.”