The Significance of consumercreditin US economy

There is no secret that consumers play an important role in driving US economy given how close everyone is monitoring US consumer confidence level. As a result, US consumer finance market is at the core of the US economy. The performance of this asset class plays a critical role in US as consumer credit market is growing at a very fast pace.

In the past, high margins on consumer assets only used to be accessible to banks and these banks still managed to obtain positive returns through the 2008 financial crisis cycle. The rise of online credit marketplace has attracts more and more qualified borrowers borrow through large online platforms to payback their outstanding bank loans.Due to the overall lower cost structure, marketplace lending can offer investors direct access for potentially more competitive returns.

Who are the borrowers of these online marketplace platforms? There is always a myth that only borrowers cannot have access into bank credits will need to borrow from these platforms. However, in fact, not all borrowers are accepted onto a marketplace lending platform. Prosper and Lending Club, the largest two marketplace lending platforms, developed standards and policies of vetting and underwriting loans with an estimated 90% rejection rate. Both of them also utilize a seven-level grade default risk ranking system to determine an appropriate interest rate for the given loan. The risk ranking system is similar to the rating process of banks or investment rating agencies.

Favorable asset class

What will it be if you have hundreds and thousands of underlying assets in your portfolios? Attributes of consumer credit are different from of traditional assets. The size of each consumer loan, by its nature, is relatively small comparing with other fixed income investment. If investors include consumer credit into the investment portfolio, diversification can be achieved with no sweat. Additionally, each individual borrower is uncorrelated with each other. Investors have access to those whose average debt to income ratio is low and higher FICO score (a type of credit score created by the Fair Isaac Corporation). Simple logic is majority of the investors prefer to go for the loans with moderate risks so it is not surprise to find out that Prosper and Lending Club tend to concentrate on borrowers with a FICO score of 640 or better in order to deliver a more pleasant return to clients. Borrowers that fit into the criteria of these platforms tend to have job stability and they tend to be on the higher end of risk grade levels.

One favourable nature of consumer credit is that the repayment of these loans are on monthly basis. This repayment nature shortens the duration of the investment significantly. Beyond doubt, the shorter the duration of an investment is, the less sensitivity of that investment to interest rate environment can be. Furthermore, consumer credit amortizes on a monthly basis, meaning monthly payments predominantly comprise principal payments on top of some interest. The principal payment can then be reinvested in new consumer loans that originate at the higher interest rate, achieving even high return in the end.

Proven historical performance

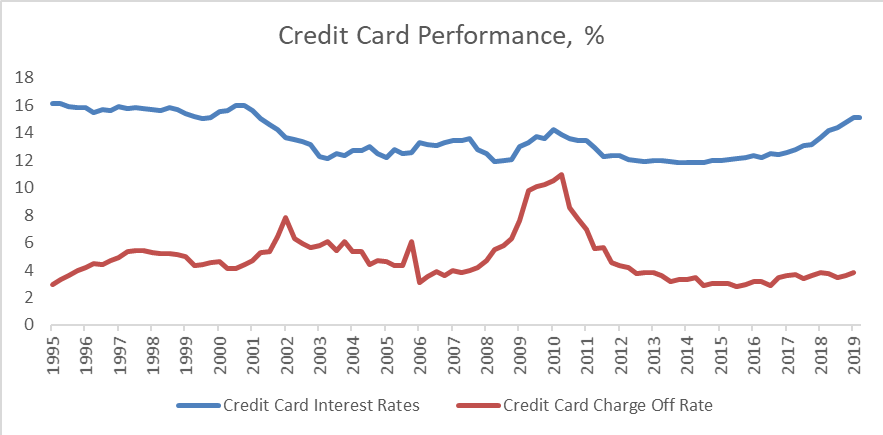

More than 20 years credit card data can be retrieved to support its performance, including the times of recession and expansion. Credit risk is primary compensated by the risk margin that lenders charge and, in consumer credits, credit margins have a significant buffer built into them to safeguard lenders during periods of economic uncertainty. Current credit card delinquency and charge- off rates declined sharply since their peak during the recession and remain lower than they were in the years prior to the recession. One may argue that the current US economy is at its peak and the investment returns of consumer credit may be at its cosmetic side as well.

The beauty of consumer credit is that, even during recessions when consumer loan charge-off rates spiked, the basis between credit card interest rates and charge-offs has historically remained positive. Therefore, no net credit margin losses ever through the all up and downs of US economic cycles.

Sources: Bloomberg, FinEX Asia

All of the above plus our technology driven risk model

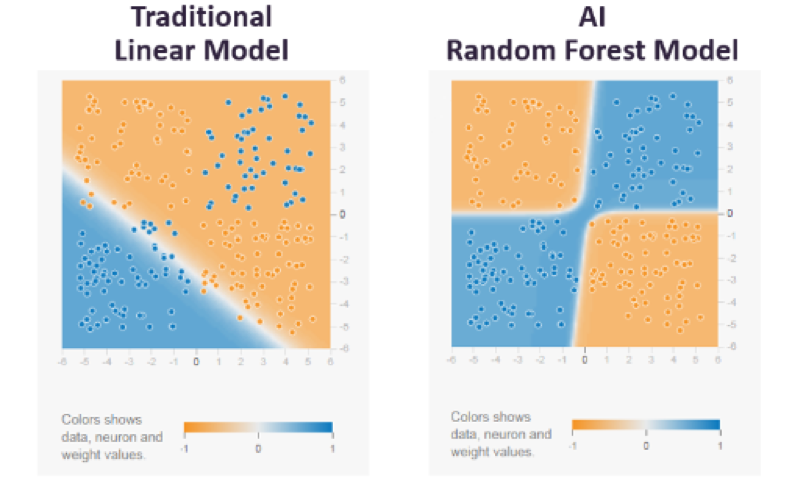

Consumer credits alone have all the features that you like about fixed income investment: diversified, stable and big in scales. How could you do to make sure you capture the returns and minimize the risks? The fundamental factor to manage the returns from consumer credit investment rests on the ability of risk management. Risk model is also the core value of managing credit risks. We use a great number of data and more than 250 data attributes to build our AI driven risk model. What does it mean? It means that our model is capable of automatically extract meaningful patterns from large datasets for decision making. As the graph below, the orange part shows the loans that will be purchased and the blue dots represent those bad loans. Our AI random forest model can have better capture accuracy of good loans than traditional linear model as it can make sense of data that is “noisy”, when random deviations hide patterns. Our machine learning algorithms continues to learn as they are fed more data and that is powerful when it comes to managing the portfolios.

Sources: FinEX Asia

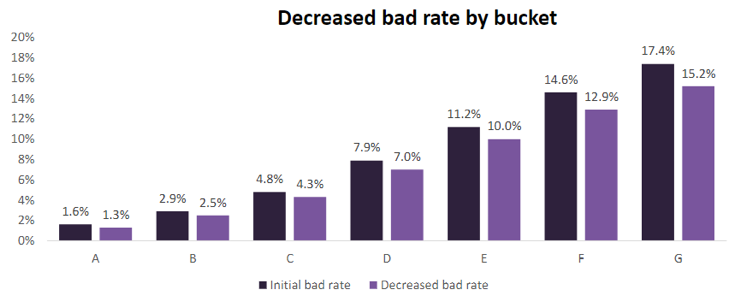

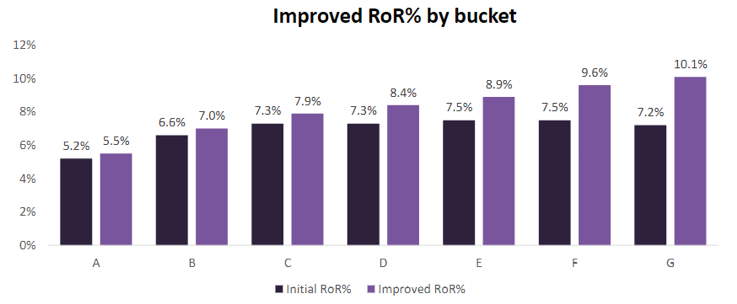

As our model can efficiently decease the bad rate, the percentage of return on revenue is improved.

Sources: FinEX Asia

Sources: FinEX Asia

When? Now!

Though global economy is slowing down, in terms of fundamentals and monetary policies, there will be always a safe haven to invest.

The appeal of traditional safe haven assets such as Cash or fixed-income is undoubtedly strong although the expected returns may not. Uncertainly tied to trade wars, worries about global weakening economy, no deal Brexit, are just some of the reasons to be cautious. Reducing portfolio volatility would be another concern to improve the risk/reward profile. What’s so special about consumer confidence and consumer credit are, they show sensitivity to broad trends impacting consumer health, such as the condition of unemployment. Consumer credit performance is much more responsive to labour market strength. The labour market in the US is at its peak performance with historically low unemployment rate and high consumer confidence level.

Although it is also one type of fixed return investment, the Fed’s policy affects the performance of bullet payment fixed income instruments much more than consumer credits. As a result, the volatility of consumer credit is much more stable than that of other traditional investment instruments. Adding US consumer credit could further diversify portfolio risks and make a positive contribution to the portfolio.