What is the current status of Brexit?

News about Brexit has been all but inescapable.

On June 23, 2016, the United Kingdom opened the booths to vote for the referendum to leave the European Union. On March 29, 2017, former UK Prime Minister Theresa May submitted Article 50 as formal notice of UK withdrawal from the EU, beginning a two-year period during which the UK and EU could negotiate withdrawal terms. However, a divided UK parliament rejected Theresa May’s proposal for withdrawal, causing May to resign in June 2019. The EU was left with little choice but to extend the negotiating deadline to October 31, 2019.

On October 17, 2019, current UK Prime Minister Boris Johnson announced a new withdrawal agreement with the EU. This new deal replaced the “backstop” with new customs arrangements to address the border issue between Northern Ireland and the Republic of Ireland post-Brexit.

What consequences would the UK feel post-Brexit?

Regardless of the terms of resolution, this dramatic high-profile “divorce” between the UK and the EU will have far-reaching consequences felt by both sides. Despite Boris Johnson striking a potential deal with the EU and Ireland, the English parliament has recently rejected an opportunity to vote on the new deal and instead elected to submit a request for negotiation postponement until January 2020. As a result, there are three possible outcomes for Brexit at the end of October:

1) The UK leaves the EU without a deal

2) The UK leaves the EU with a deal

3) The UK has a revote on Brexit.

Although any postponement request will still need approval by the EU parliament, it appears unlikely that the UK will vote on the current deal by the end of October – further clouding an already murky situation.

Belonging to an EU member country, UK firms can export to third-party countries under the umbrella of the EU’s 40 negotiated trade deals that span 90 countries. However, in the event of a “hard” Brexit without predefined arrangements, the UK would lose tariff-free access to these markets and would be subject to World Trade Organization (WTO) trade rules. Trading under WTO rules would require the UK government to strike bilateral duty arrangements with all trading partners to avoid trade tariffs and custom controls.

To subvert this, the UK is working to roll over the EU’s existing free trade deals; however, while they are attempting to replicate the EU’s trade agreements “as far as possible” in the event of a no-deal Brexit, the UK will likely be unable to expedite trade deal negotiations (that typically take years) to mere months in order to sign a free-trade deal with the EU or other countries before withdrawing in 2019.

Importing goods from the EU will likely become more expensive once the free movement of goods concludes following the UK’s exit. Under a “hard” Brexit environment, the UK would face tariffs and border controls set by the EU. Most industries in the UK would be heavily impacted – particularly the manufacturing sector.

The UK is a key global automotive player. According to the British Automobile Manufacturers and Dealers Association, in 2013, the UK produced a total of 1.6 million vehicles, which is equivalent to a new car every 20 seconds. 77% of total vehicles produced were exported internationally. Additionally, 19 out of the world’s top 20 auto-parts manufacturers have production factories in the UK.

As tariffs would directly erode auto manufacturer profits, many companies have begun to move their production locations to other countries. In addition, supply chain efficiency could be impacted by a “hard” Brexit. Imported materials for car-making and ready-to-ship products could be delayed or charged “additional storage management fees” due to “customs clearances.” As a result, manufacturers would need to increase inventory levels to strengthen supply chain management, indicating a need for additional space to store cars and exacerbated inventory management issues.

In 2018, the EU accounted for 46% of UK exports. However, as EU member countries’ imports from countries outside the EU are uniformly subject to tariffs, any additional tariffs introduced to the UK after Brexit would dramatically raise the cost of exports and consequently greatly reduce competitive advantages relative to competitors located within EU member countries.

The movement of the Pound against the Euro

The GBP has been under pressure since the Brexit referendum took place on June 23, 2016. The fall in GBP value has undoubtedly intensified ballooning manufacturing costs in the UK. While a falling GBP could help bolster UK exports and thus mitigate some of the impact of rising tariffs, it would also result in rising raw material import costs.

Source: Bloomberg

The optimal scenario is one wherein Britain exits the EU but remains within the EU’s Single Market through membership in the European Economic Area (like Norway), the European Customs Union, or both. Based on recent remarks from Boris Johnson, he still believes there is a “way forward.” With a deal, the UK would pay a divorce bill of ~39bn GBP and enter a transitional period to exit the EU Customs Union, thus buying time for trade deal negotiations with other countries and potentially managing the economic impact of Brexit.

Brexit uncertainties slow the UK economy

The Bank of England has cut economic growth forecasts and kept interest rates unchanged at 0.75% as uncertainties around Brexit result in “slowed and volatile” economic growth in the UK.

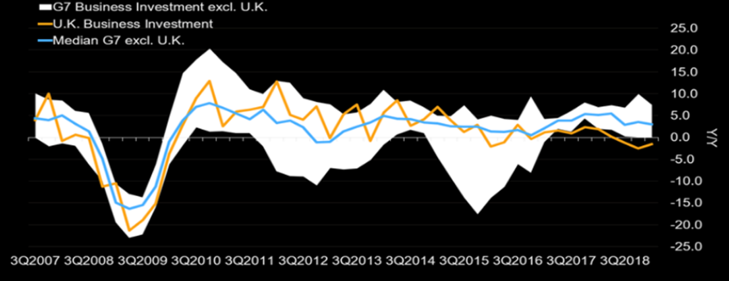

There is a growing fear that uncertainties around Brexit will push the UK into recession. The UK economy is currently forecasted to grow at a rate 1.3%, down 0.2% from May 2019 projections of 1.5%. Domestic investment from UK firms has weakened since 2016 as the UK-EU membership referendum has driven companies to relocate head offices or production lines out of the UK. Even amid a strong synchronised global economic recovery in 2018, capital spending in the UK fell every quarter.

Brexit impact on business investment

Sources: Bloomberg, National Statistic Agencies

Under a smooth Brexit, the Bank of England anticipates increasing interest rates to balance out a probable price rise in goods and services, which will help reign in inflation at the 2% target.

While the Bank of England has been planning under the assumption of a smooth Brexit, it also anticipates that a no-deal Brexit, a distinct possibility under Boris Johnson, will put significant pressure on the economy. As mentioned earlier, a no-deal Brexit would push up domestic goods prices and lead to a fall in the GBP. As consumption is currently the main driver of the UK economy, any discerning threat to consumer spending would negatively impact the UK economy.

Global economic impact of Brexit

The UK-EU divorce has always been more political than economic. While a no-deal Brexit is an option, neither the UK nor the EU are prepared to face the subsequent fallout that follows. From top to bottom, nearly every industry would feel the consequences. For example, how would the EU operate without the annual economic growth contribution from the UK? How would financial institutions in Europe respond to the sudden pressure thrust upon them by a no-deal Brexit?

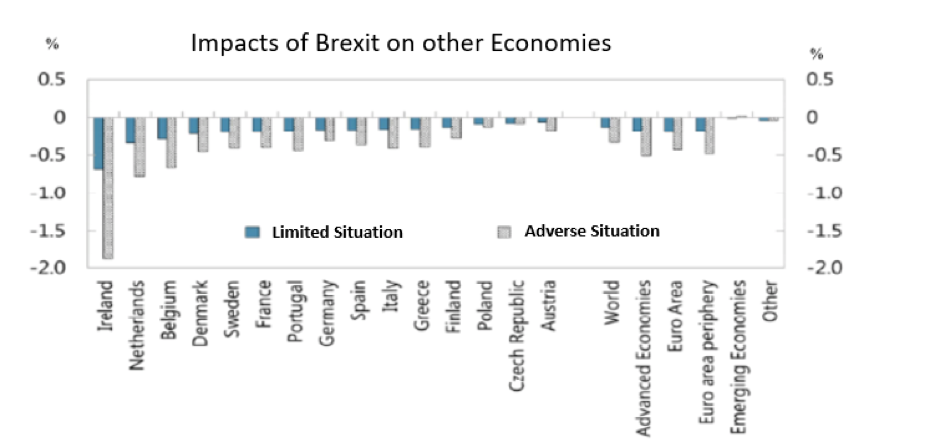

The IMF report addressing the “Uncertainty in the Aftermath of the UK Referendum” concluded that the world economy will suffer to some extent due to Brexit and that Ireland would experience the greatest impact on its economy.

Source: IMF

Ireland, alongside the Netherlands and Belgium will suffer the largest proportional loss while all countries that had trade with the UK will undoubtedly bear the cost of Brexit. However, some countries outside the EU, such as Russia and Turkey, could net gain from the withdrawal as trade flow fallout from the UK will likely divert towards them.

The threat of Brexit has loomed for three years. Tensions between the Prime Minister and Parliament has already claimed one PM and could potentially lead to a second resignation. As the market begins to price in the possibility of a 2020 deal, GBP value may begin to stabilize; however, though uncertainties surrounding Brexit may be showing signs of settling, the risks surrounding Brexit are ever present until a deal is finalized.