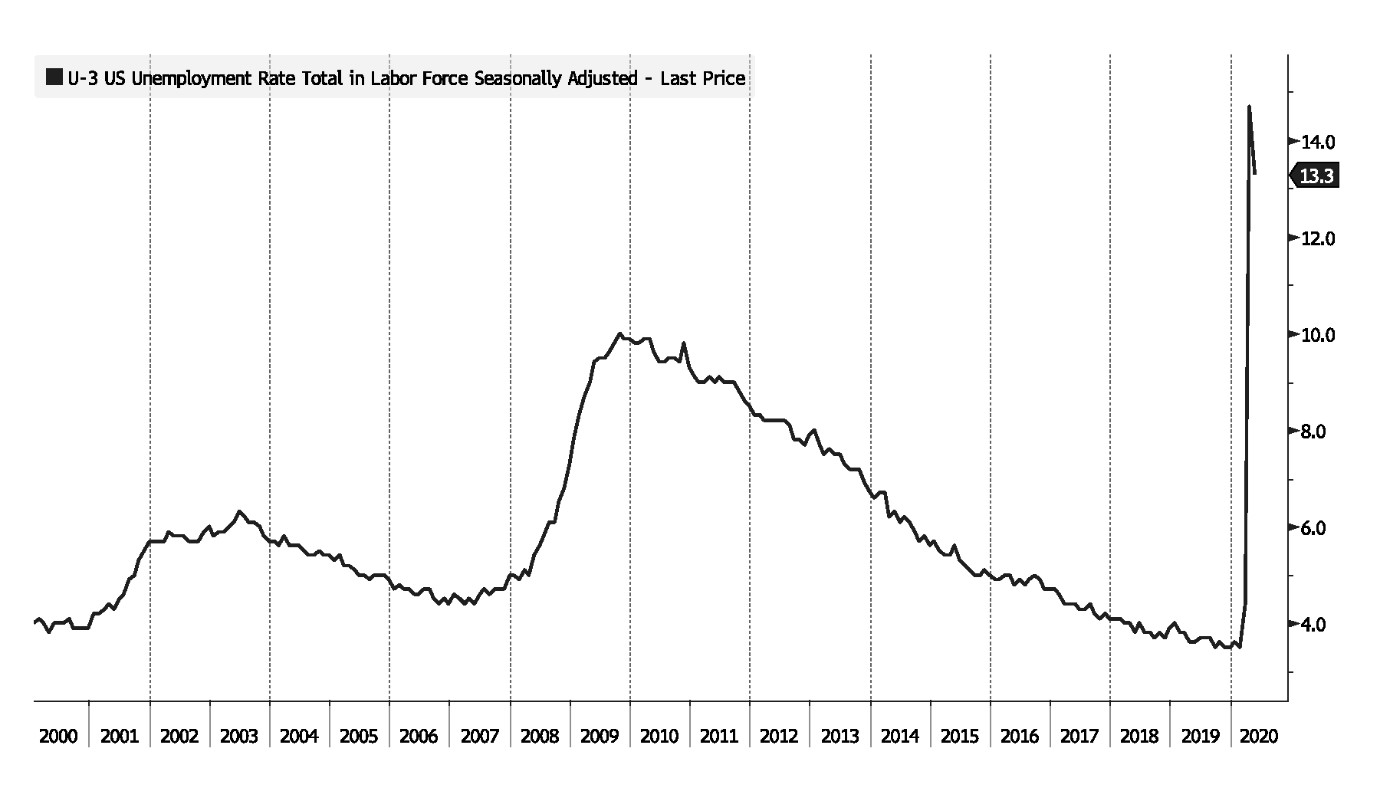

It is difficult to conclude that we will ever be the same after the chapter of COVID-19. The events of the last few months interrupted one of the longest economic expansions in the US history. Before the virus struck, US unemployment rate was at 3.5%, the lowest in one decade and personal savings rate was at the healthy 8% level. There was simply no sign to indicate any weakness in the economy even with the wave of deglobalization gradually coming into the sight in the global markets.

We are indeed going through a rare and remarkable time.

The surprising employment number for May shall make us realize that this is not a normal economic cycle. The number of Americans filling for unemployment benefits eased to 1.877 million in the week ended May 30th, the lowest level since COVID lock down began.

Source: U.S. Department of Labor, tradingeconomics.com

While the continued jobless claim amounted to almost 21.5 million, the unemployment rate in May fell to 13.3 percent with a gain of 2.5 million jobs.

Source: U.S. Department of Labor, tradingeconomics.com

The unexpected fall of the unemployment rate, according to the Department of Labor, may contain some statistical error pertaining to the potential mislabeling of employment status. We do see the positive sign of the number of jobs that are created. Non-farm payroll tends to be adjusted due to the fluctuation of seasonal factors and also statistical errors and the current protest across the US may lead to potentially more revision in the future. We tend not to focus too much on the unemployment rate but rather how many jobs are created.

With the total loss of 21 million jobs since the pandemic, in April, 18 millions of them said they were temporary laid- off and by mid-May, 2.7 million workers have started returning back to work. The trend of how many jobs have resumed as usual after the gradual opening up of the economy is the key element that we care about.

It will be naïve to assume that as the economy reopens, everything including the job market will revert back to normal. There are unfortunately, jobs, that are lost permanently. The current recovery is from those who “return to work” while their jobs still exist. The “snap back” is the easy part of the recovery of COVID. The more difficult part is from those sectors and business that have been hit harder and may take longer to recover such as tourism, airlines, entertainment, retailers, restaurants, private healthcare, and education. Some of the businesses amongst these sectors may close or permanently downsize before the new business rises even after the end of social distancing. As we have stated in our analysis following the pandemic investment series, the main risk of this unprecedented economy shut down is to try to prevent the “bad” from spreading to the “good”.

Source: Assured Asset Management, Bloomberg

Following the past economic cycle, once the jobs are permanently lost, it might take up to 7 years to recover depending on how severe the downturn of the economy was.

According to Bureau of Labor Statistics, there was around 130 million jobs in September 2010 and from then through February 2020, there have been 22 million jobs created. In the months of March and April of 2020, all of these 22 million jobs were lost.

What the current increase of jobs has told us is that at least part of the pain in April was created by the workers whom were temporary laid off or simply they could not book any income due to the lock down but still have strong connections with their employers.

Source: Assured Asset Management, Bloomberg

Of course, the wise investors will not to be blinded by the burst of the enthusiasm due to the lifting of stay-at-home orders. However, please always remember before the pandemic hit, the US economy was as healthy as it has ever been.

As we mentioned in the above, the personal savings rate before the pandemic was at a healthy 8% and the loss of the jobs does not bring down the savings rate. Personal income increased US$ 1.97 trillion (10.5%) in April and this increase was impacted by the response to the spread of COVID-19, as federal economic recovery payments were distributed. In the meantime, due to the continuance of the stay-at-home order, the personal consumption expenditure decreased US$ 1.87 trillion (13.6%) causing personal savings rate to be 33% of the personal disposal income (“DPI”).

What this means is that even though the full recovery may take considerable time, the energy of personal consumption is stored but not loss.

Source: U.S. Bureau of Economic Analysis

Investors should act upon opportunities that are temporarily beaten down by the sudden shut down of the economy. The most material issue, or some may categorise as risk, for the market is low interest rates for a significant period of time. With Fed rates and treasuries close to zero, people will need to alter their asset allocation materially.

The US policy response to the COVID-19 pandemic is huge and rapid. The Fed has created various programmes to support the economy and financial markets and the influence has been significant. Holding excess cash is, in our view, the costly strategy in today’s ultra-low interest rate environment. We encourage investors to seek opportunities to put cash to use and seek yield, while maintaining diversification.