No Win of the Trade War

On May 10th, the Trump administration began to slap higher tariffs on Chinese imports worth US$200 billion from 10% to 25%, jeopardizing a trade deal currently being negotiated by the two countries. On May 13th, the US and China intensified their trade tension, as Beijing said it would increase tariffs on nearly US$60 billion worth of American goods and the Trump administration detailed plans to tax nearly every sneaker, computer, dress and handbag that China exports to the United States.

It is difficult to predict in which direction the negotiations will go, but the trade war between the two economic giants place stress on growth and potential negative impacts on income and prices. Financial markets, without surprise, saw great volatility after China detailed plans to increase tariffs on May 13th, with the S&P 500 index down more than 2.4% for the day and more than 4% this month. Shares of companies particularly have trade with China, such as Apple and Boeing, fared poorly. Also, the US yield curve once again inverted – yields of US 3-month Treasury exceeded those on 10-year ones. Market sentiment suggests that the outlook for long-term and short-term economic growth isn’t so optimistic if the trade tension further deteriorate. Although the endgame might not be as bad as it seems, trade war disputes for sure exaggerates market volatility.

Dollar is treated as safe heaven when investors perceive increasing risks, its value relative to RMB has greatly risen, a signal that markets fear future trade uncertainty. With dollar appreciation, Trump faces another problem that US exports will be more expensive, which adds hardship to increase its trade balance.

IS Cutting Rate on Fed’s table?

The Trump administration urged the Fed to cut the rate to offset the Economic hardship caused by tariffs. In fact, before the trade war dispute, the Trump administration have kept up pressure on the Fed for a rate cut to supercharge the economy. However, the Fed in the May meeting kept repeating that “will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate”. The voice from the committee doesn’t sound that Fed intends to lower interest rates based on current economic condition.

On May 1st, Fed maintained the target range for the federal funds rate at 2.25% to 2.5%. Fed Chair Jerome Powell said the central bank was comfortable with its current policy stance and does not see a strong case for moving in either direction on interest rates. He appeared to brush off concerns around recent declines in core inflation. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Growth of household spending and business fixed investment moderated in the first quarter yet still on its uptrend while the consumer sentiment continued to spike. On a 12-month basis, overall inflation and inflation for items other than food and energy have declined and are running below 2%%, which are considered well contained following Fed’s long-term target, so dose its key inflation metric, core PCE.

US Labor Market is Robust, but More to Observe

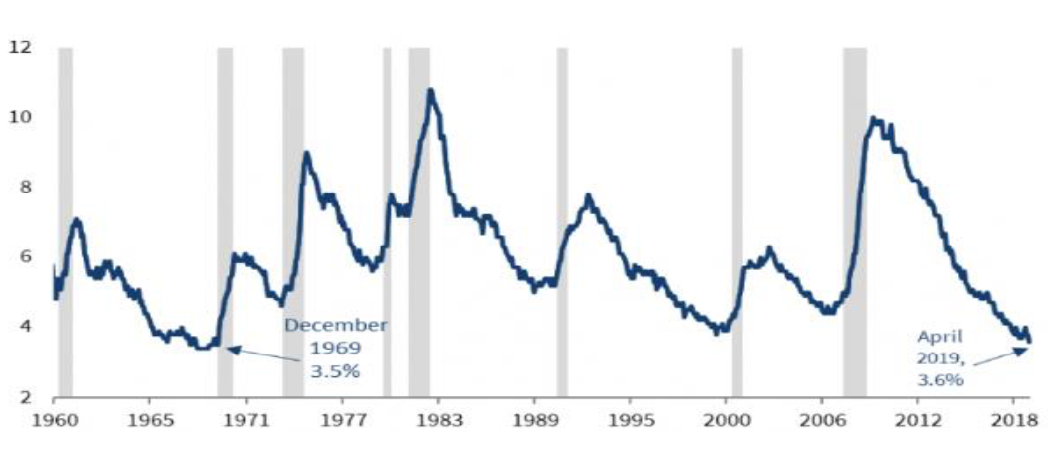

US Unemployment Rate (%)

Source: Bureau of Labor Statistics

In April, US economy gained 263,000 new hires and unemployment rate fell to 3.6%, the lowest level since 1969, which easily beat market expectation. Almost every demographic group benefit from the growing economy. The U-6 unemployment rate, a broader measure of unemployment that includes those who are unemployed and working part-time for economic reasons, remained at 7.3 % in April, matching the lowest U-6 rate since December 2000.

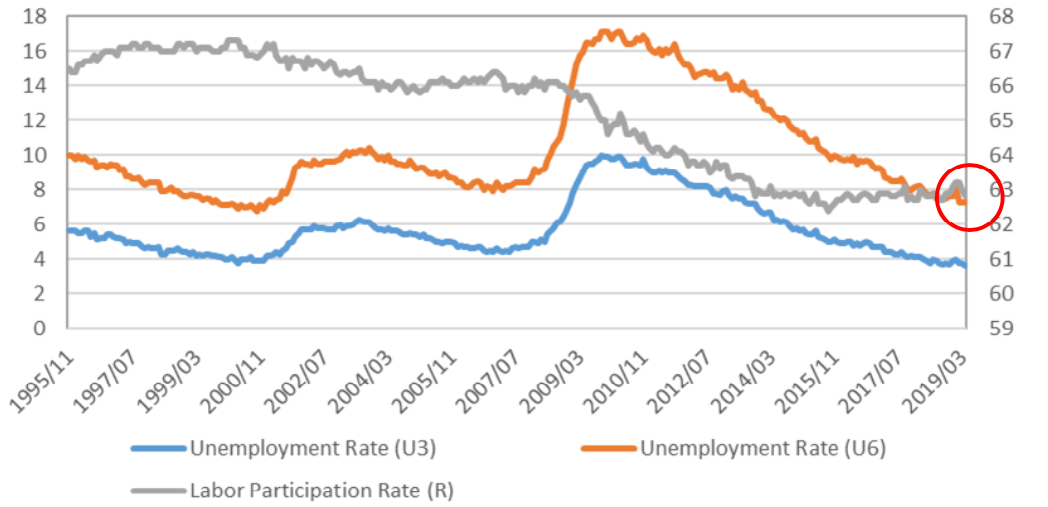

Source: Bloomberg

The decline in the unemployment rate was driven largely by the most people leaving the labor force. Taking the size of the labor force, it contracted in April by nearly half a million people and fell for the fourth straight month. Larbor-force participation rate slipped to 62.8% from a six-year high of 63.2% in January.

Moreover, including revisions for the months of February and March, the average pace of job growth has been a healthy 218,000 jobs per month over the past year and 205,000 jobs per month so far in 2019. However, through the first one-third of 2019, America’s monthly average job creation demonstrates an inspiring number by adding205,000 new jobs, but it’s still down by 6.7% compared with 220,000 newly added jobs of the first one-third of 2018. Economy is strong, but the momentum is considered moderate comparing with the speed growth in the past one year.

Is US inflation transitory?

Personal Consumption Expenditure Price (“PCE”) index and CPI index are the two consumer price indices applied in US In terms of the constitutions of the two indicators, different weight distribution brings up weighting effects. As PCE adjusts weights of the basket more frequently, it better reflects the substitution effect of goods. The Fed refers PCE index as the main inflation indicator to establish monetary policy. It slightly lags CPI index. The inflation mentioned below is PCE.

As earlier oil price declines, overall inflation fell at the start of this year. Gas prices are moving higher, which will likely lift inflation in the coming months. Overall inflation for the 12 months ended in March was 1.5%. Inflation excluding food and energy prices unexpectedly fell as well, and as of March stood at 1.6 % for the previous 12 months through March compared with 1.95 % in Dec. 2018. Even though Powell thought some transitory factors, such as fund management fees, apparel prices and air fares lead current low inflation, we shall watch on the near future inflation data. If inflation is still too low and actual inflation doesn’t seem to be picking up, concerns of the overall economy shall be raised.

Moreover, nominal average hourly earnings in April rose by 3.2 % over the past 12 months, marking the 9th straight month that year-over-year wage gains were at or above 3 %. However, average hourly earnings grow even faster than the inflation rate. Inflation has remained subdued.

Looking ahead

Trade war will have negatively impact on the global economy at different extent, but how serious the outlook is shall wait for the final deal between the two parties. Recent data show the Philips curve presents relative weak relationship between unemployment rate and inflation. The theory originally claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment. US labor market continues to tighten, yet there is no sign of inflation and financial conditions have moderated. The Fed has vowed to be patient and data-dependent, monitoring the conditions of the economy and financial markets. We don’t see rate hikes in 2019. However, if trade war hurts economy and inflation couldn’t pick up, the possibility of rate cut would increase. Having said that, we don’t think recession will happen in 2019 even the yield-curve inversion came to warn.