(Angie Lin, Co-Founder and Chief Investment Officer of FinEX Asia, is the author of this article, which is reproduced from the column “Politics and Economy 800” in Taiwan Commercial Times on 26 March 2019)

While managing the liquidity of assets has long been the key topic in the asset management industry, how to maintain good liquidity and to provide investors with higher return has even been an arduous task which is not easy to fulfill. However, with its development of over a decade, Fintech has now opened up a simple way for investors to enjoy benefits without compromising on liquidity and enduring long period when investing in high-yield products or new asset classes.

Being Powered by Fintech, Online Credit Becomes a Main Trend in the U.S.

According to the Industry Insight Report recently published by TransUnion, online lending platforms, as the main driving force of growth, pushed the amount of U.S. personal loan up to 21 billion dollars throughout 2018, together with the overall scale reaching the historical peak of 138 billion dollars. Currently 38% of lenders who offer personal loans come from online lending platforms, accounting for 52.44 billion dollars and is the highest proportion in all industries. Compared with the ratio of 5% 5 years ago, the growth rate has been surprisingly high.

The market share of online lending platforms in the US personal loan market hit a historical high in the fourth quarter of last year. Meanwhile, traditional banks have gradually lost their inherent advantages in this sector. Referring to the statistics of TransUnion, the market share of banks in this sector has continuously dropped from 40% in 2012 to 28% today. Credit cooperative also declined from 31% to 21%.

Personal loan has become a type of credit products by virtue of online lending platforms. 19 million consumers have already been possessing personal loan products, according to TransUnion, which has increased by 2 million when compared with last year. Rapid growth of the personal loan market is due to not only the simplified processes and incentive created by cost reduction, but also the fact that Fintech has transformed “loans” into investable products and achieved liquidity control and management in volatile market in order to attract capital investment.

No More Frustrations for Investors

Consumer credit products begin to circulate in the market since the emergence of online lending platforms. The platforms, through technological means, can promptly evaluate credit risks and provide appropriate risk coefficients and applicable loan interest rates by using the database containing loan applicants’ background. Platform investors can choose suitable underlying claims for investment in accordance with their risk preferences. Funds from institutional investors, venture capitals, financial institutions and hedge funds support the rapid growth of online lending business.

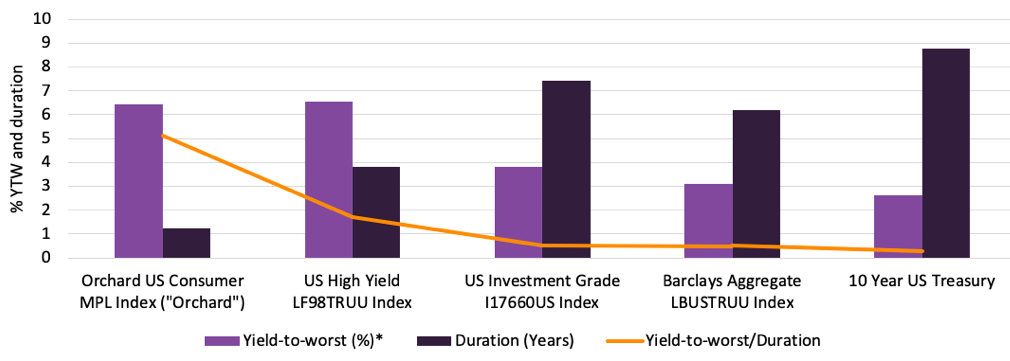

One of the main reasons why consumer credit appeals to investors is thatit can offer higher yield rate in shorter investment period when compared with traditional fixed income products. A comparison between US high-yield bond and US online consumer credit is shown in Figure 1. The average duration of US high-yield bond index is 3.83 years, with average investment return of 6.54%. In contrast, the average duration of US online consumer credit is 1.25 years but the average investment return is 6.42%, mainly because the principals are repaid by installments, renderingits duration shorter than those of high-yield bond index, investment grade bond index and US Treasury bond. The substantial increase in return, on the other hand, is due to the significant reduction in cost facilitated by Fintech. Thusin terms investment return and duration ratio, US online consumer credit outperforms bond, meaning that the former can generate the highest return where investors can enjoy high-yield investment without needing to endure long term and give up liquidity over the same investment period.

Figure 1: Comparison of Return and Duration between Consumer Credit and Traditional Fixed Income Products

Data Source: Bloomberg, FinEX Asia

Secondary Market Transactions, Cash Flow Systematization, Good Liquidity Management

Moreover, the flourishing development of consumer credit can foster better liquidity management, which is one of the reasons why investors are attracted. The control and management of liquidity involve cash flow management of claim, principal and interest income, as well as the secondary market. In secondary market, well-established platforms can attract buyers from institutional legal entities, venture capitals, financial institutions and hedge funds, and thus stimulate the flow of credit assets.Fund managers investing in US online consumer credit can purchase or sell consumer credit claim from or to the market or other funds, in which the prices are subject to the credit score and loan period of the loan itself. Individual investors may not be able to participate in this kind of secondary market transaction at this moment. However, as the transaction amount increases with time, there will be more and more participants in the market. Improvement of liquidity in credit transaction market therefore produced is one of the most important contributions of technology to the consumer credit market.

FinEX Asia, as an example, may offer financial products with shorter terms to help investors in alternative cash management investments by adopting long and short-term credit portfolios, claim trading and cash flow management.

If you do not want to be frustrated anymore and are looking for more efficient fixed return investments, why not seek help from Fintech?