Following the research titled “US-China Trade War Tension Has Risen. Who will be the Winner?”, US and China, the two biggest economy continue to capture the spot light for the trade battles. We don’t think there is a winner amid of the trade war. In 2018, the International Monetary Fund (IMF) simulated the economic consequences of mounting China-US trade tensions and concludes that the GDP of the US and China will be reduced by 0.9% and 1.6% in 2019, respectively, leading to a roughly 0.4% fall in long-term world GDP.With the higher tariffs announced in May and further possible tariffs on the rest of goods, the full effects on GDP growth would be even more severe. The trade war effects are not restricted to China and US only. The rest of the world will be surely contagioned from the war to some extent.

Will higher tariffs guarantee US trade surplus?

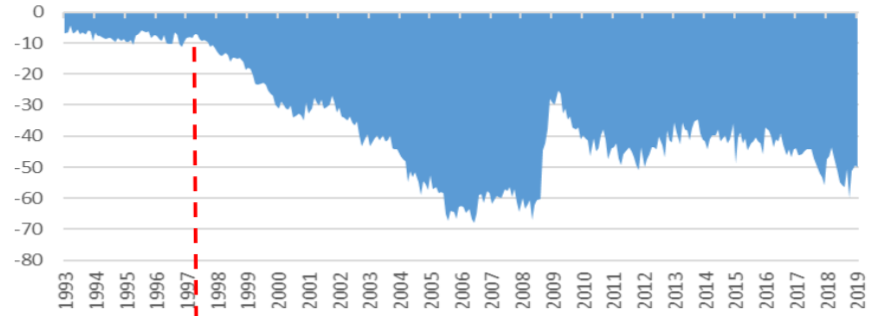

During the time of trade dispute, US President Donald Trump keeps repeating that China takes trade benefits from US as granted for a long time, which negatively impacts US trade balance. Trump adminstration now is charging China with higher tariffs in order to reduce US trade deficit. However,way before China joined WTO in 2001, US trade balance with the rest of the world had experienced deficit. Obviously that even US does not import from China, US importers will need to source cheap goods from the rest of the world such as Vietnam, Thailand due to expensive domestic resources. Therefore, we are not convinced that the trade talks in any way will help US to change their current trade balance from deficit to surplus.

US Trade Balance (US$ billion)

Sources: Bloomberg

The challenges ahead of China

According to China General Administrative of Customs, the total trade volume with US amounted to US$ 583.7 billion, among which US$ 429.8 billion is exported to the US and US$ 153.9 billion is imported from the US. China’s exports to the US account for 18% of China’s total export while total goods under current (US$ 34 billion) and potential (US$ 200 billion) tariff may account for 54% of the total export the US.

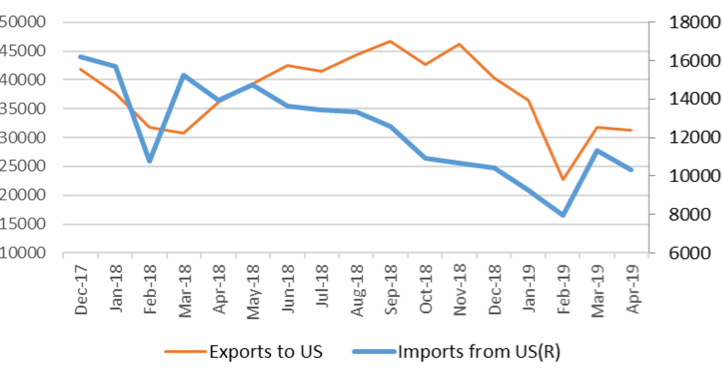

With the rising of US tariff, there is no doubt that China will be affected. As shown in the graph below, the impact of imposed tariffs by the US in 2018 is already evident in China’s trade data.There was a delay between announcement and implementation of tariffs, as in the case of the US$ 200 billion list initially tariffed in September 2018, we observed an increase in import growth in advance of the effective dates. This suggests that importers stocked up ahead of the tariffs, accounting for the sharper decline in imports thereafter. China’s trade partnership with US could further deteriorate in the later months after May tariff hike imposed.

As China imposed retaliatory tariffs, US exports to China also declined. While US exports to China has been gradually weaker since the trade tensions began, the deterioration is not as steep as it in China. Trade war between the two parties starts to show the consequence and further lift market uncertainty.

China Exports to US & Imports from US (US$ million)

Sources: Bloomberg

Which business sectors will be affected the most?

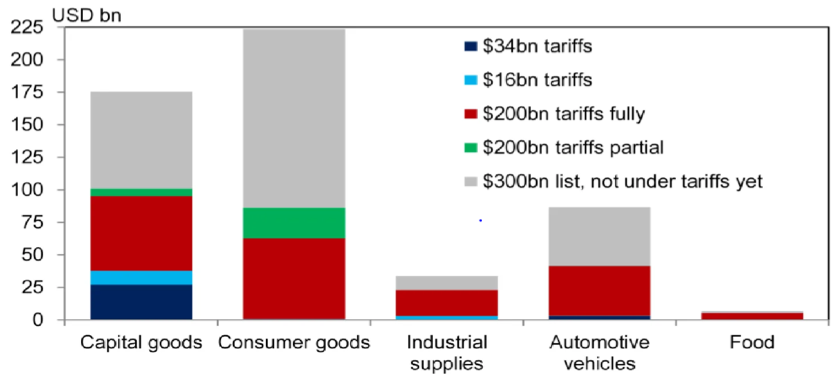

Starting from 2018, Trump’s list of items to be tariffed has come in four stages. The first two stages affect roughly US$ 50 billion worth of imports from China. The third list, which went into effect on September 24, 2018, affects US$ 200 billion worth of goods. List 4, not yet in place, will cover all products not currently hit by List 1, List 2, or List 3. The first two lists have 25% tariffs, While the third list started at 10% and escalated to 25% on May 10, 2019.

The first two lists mainly targeted on non-consumer products such as industrial products, medical products, transportation products. Products on List 3 are much more consequential. 40% of those products are consumer goods such as furniture, electrical equipment and apparel. A lot of the goods on the lists are foreign goods manufactured in China. Hence, the impacts on global supply chains and the consumers will be bigger.

US Implemented Tariffs on China on Section 301 Investigation (US$ billion)

Sources: United States Trade Representative, USTR

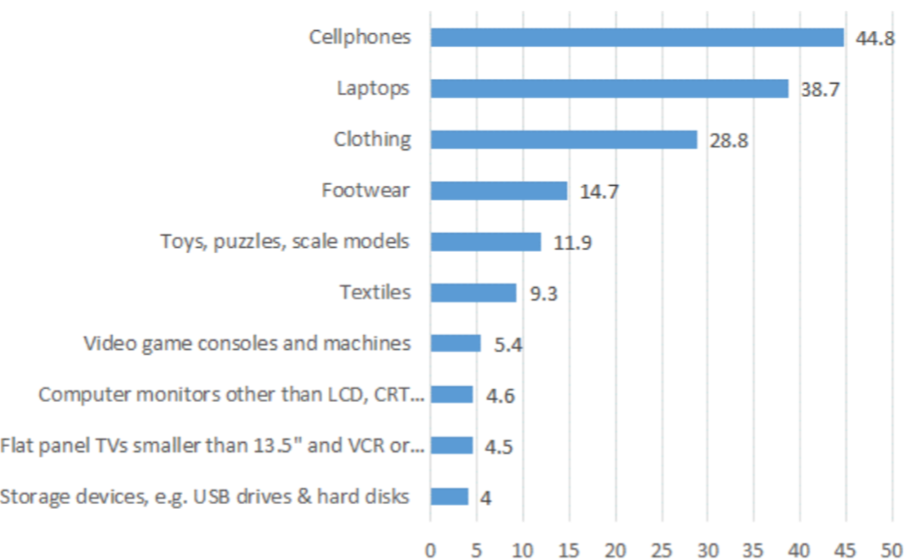

Top 10 Chinese goods on latest US tariff list (value of imports from China in 2018 in billion US$)

Source: US International Trade Commision

Who are the ones paying the price?

Direct impacts of tariff hike will be hitting the consumers and producers in both countries, the cost is comprised of additional tax burden and an efficiency loss. According to the data form the US Bureau of Labor Statistics on the imports from China, the tariff costs are almost completely passed through into increased prices paid by US importers. With no change of the border price of imports from China, the after-tariff import price went up a lot. Obviously, the rise of the tariff cost is shared by both consumers and importers, the trade war costs the consumers paying higher prices for the same goods and importers suffering from reducing their profit margin.

On the other hand, trade effects on producers are mixed. For the US companies that depend heavily on supply chain in China, such as Apple, not only its cost level will be lifted, the revenue level will be dragged down. However, with high imported tariff, US domestic producers and third country exporters will be benefited instead. Aggregated bilateral US data does suggest that trade diversion has occurred, as the decline in imports from China appears to have been offset by an increase in imports from other countries. For example, US imports from Mexico increased significantly among some goods on which the US has imposed tariffs on. After the US$ 16 billion list was implemented in August 2018, a sharp decline of nearly US$ 850 million in imports from China was almost completely offset by about US$ 850 million increase from Mexico, leaving overall US imports broadly unchanged.

Is the Fed now open to a rate-cut?

According to the latest US beige book released in June, we see that US economy is still expanding, but with a modest pace. It shows that US economy growth is not as strong as last year; especially there is more uncertainty amid of rising trade tensions between the two big countries.

“We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.”

—Jerome Powell

From Powell’s recent speech, it signals that if US economy starts to deteriorate, the Fed is open to cut rate to keep the economy going. Currently, the Fed faces a problem with inflation, which has yet to sustain at the central bank’s 2% goal and the Fed cannot predict the economic results from the trade disputes. For the future, the Fed should keep watching on three main considerations, where current policy is enough to address inflation misses; if the Fed’s toolkit of rate moves and asset purchases is enough to achieve the dual mandate of full employment and price stability, and how best to communicate policy to the public.

With the recent development and modest pace of economy growth, we are now open for a chance for one or even two times of rate cut starting from the later months of the year to activate stabilize the economy, yet for sure, it will take more evidence to confirm the possible and appropriate move for the Fed, and we shall continue the watch of economy growth and trade tension closely.