Holding cash or putting money in a bank may be a safe option but returns will be meagre. So, what are the options for investors seeking high yield and low-risk solutions?

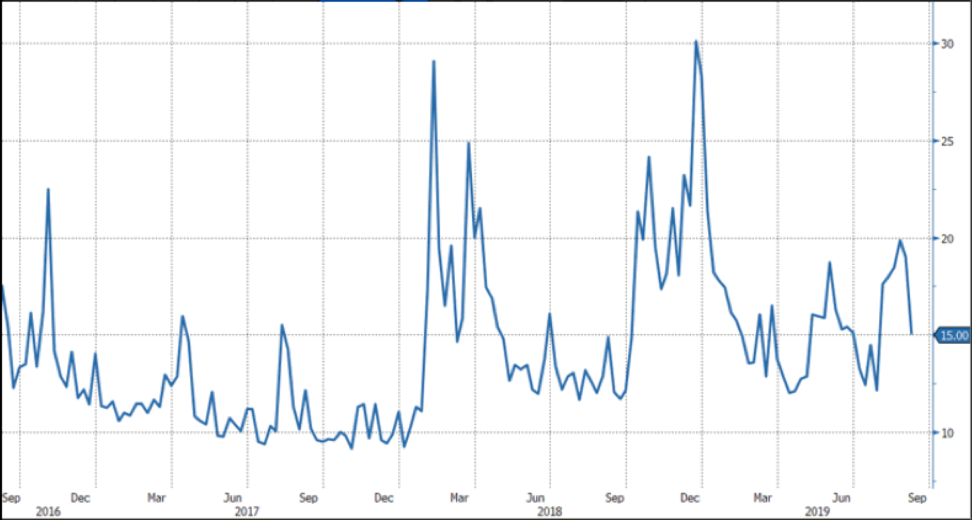

Volatility is dominating the financial markets in the past two years. Investors may try to time the market but buying and selling orders around future market price movements are particularly challenging.

CBOE Volatility Index

Source: Bloomberg

Although an approach to avoid risk and volatility is to keep your money in a bank, the interest rate for savings accounts is typically less than 0.5%. Another safe investment option to preserve capital is to invest in low-risk assets such as Treasuries and certificates of deposits. However, the US 10-year note, one of the safest and least volatile fixed income instruments, is returning only about 2%. With the current rate of inflation hovering around 3.3% in Hong Kong, the yield from such assets is virtually negligible. Depositing hard-earned money in Time Deposits or Certificates of Deposit aren’t the appropriate solutions either. Depending on the duration of the deposits, these returns are generally less than 2%.

What then are the options for investors who want to avoid volatility, preserve capital and achieve reasonable returns? In the current investment environment, US-China trade war tensions remain high; the US Federal Reserve is widely forecast to cut interest rates again this year. These were some of the factors that caused fluctuating markets and drove virtually all asset classes to the red last year. By the end of 2018, bonds, stocks, commodities, and currencies except greenback fell. An individual invested in these major instruments, seeking diversification, wouldn’t have gained much from diversification.

Risks in High Yield Bonds

Investors typically need to be willing to accept higher levels of risks to achieve higher yields. To benefit from higher returns in the fixed income market, investors may choose to buy high-yield bond funds. While invest in high-yield bonds, comparing with stocks, can help to decrease overall portfolio risk and improve the consistency of return, they do not insure against loss. The asset class is also subject to volatility, although to a lesser degree compared with equities.

For investors, the ultimate goal is to find an asset class that is not deeply correlated to market volatility. Studies show that the US consumer credit has a low correlation with other asset classes and has a relatively low sensitivity toward US Fed’s rate decisions.

Volatilities and Returns Among Different Asset Classes

| FinEX MPC Fund | Bloomberg Barclays Global HY | S&P 500 Bond Mega 30 IG 3-5Y | S&P 500 HY Corporate Bond | ||

| YTD | ITD | YTD | YTD | YTD | |

| Volatility | 0.10% | 0.37% | 2.66% | 2.11% | 2.37% |

| Absolute Return | 4.14% | 13.54% | 9.95% | 6.10% | 11.60% |

* Since Oct 2017 fund inception; YTD as end of July 2019

Source: Bloomberg

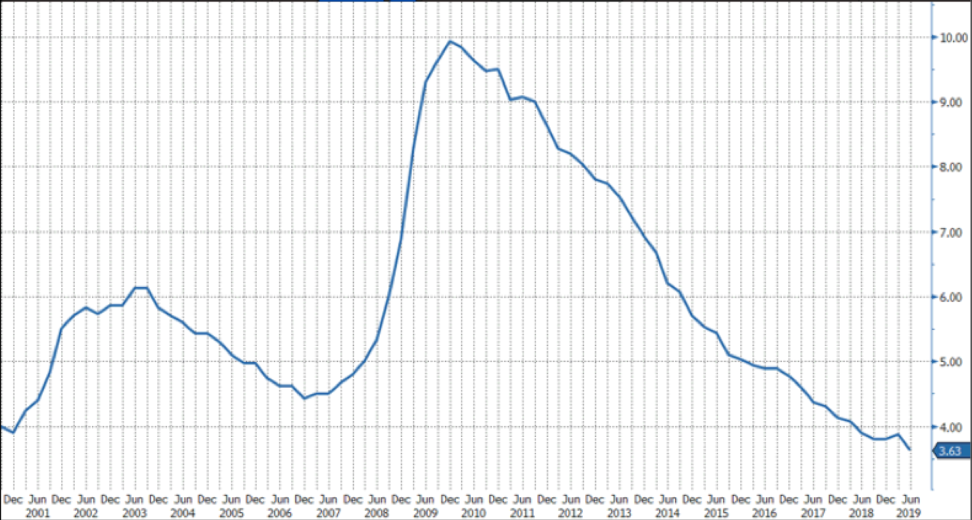

Consumer Credit Is Less-Rate Sensitive

The impact of US rate movement on debt securities is generally greater and more straight-forward compared to consumer loans. The market value of US Treasuries, for instance, is affected mainly and inversely by interest rates. For consumer credit, other factors like continued employment may exert a more significant influence on returns. When cutting interest rates is expected to bring more volatilities to the market, the less rate-sensitive consumer credit can provide a natural hedge and provide portfolio diversification.

The key risk to US consumer loans is still loan default. The current interest rates are still at historic lows, further, other economic indicators are favourable. US economic statistics still point to a low probability of consumer loan default. Based on the latest government data, the US jobless rate still holds near a half-century low and average hourly earnings tops forecasts despite a slowing down in new jobs added due to the trade disputes. Average FICO (Fair Isaac Corporation) scores – the standard measure of US consumer creditworthiness – have been rising. Debt as a portion of income, and loan delinquency rate are all low.

US Unemployment Rate

Source: Bloomberg

As the market remains mired in uncertainty, US consumer credit which has delivered 20-plus years of positive net returns even through crisis years and provides a yield more stable compared to high-yield bonds, may be the answer for investors wishing for an asset class that ensures stable and enhanced returns.