Tepid Growth Amid Volatile Headwinds

Despite persisting global uncertainties, we hold a cautiously optimistic outlook for the world economy in 2020. Major headlines, including the US-China trade war and Brexit, are likely to continue influencing the global economy; however, the 2020 macro environment may mark a stark shift from the dynamics of 2019 – a year characterized by an unusual late-cycle dovish pivot by central banks to help offset the negative effects of rising trade tensions.

2019 in Review: Time to Prepare for 2020

2019 has been a turbulent year for global asset performance. Macroeconomic factors like Brexit and the Trade War aroused salient market swings through weakening global economic momentum and heightening geopolitical risk. The global economic slowdown dragged overall manufacturing, with a decline in industrial production sounding alarms on profitability concerns amid lower earnings.

Assured Asset Management Launches Supply Chain Finance Solution with Shui On Group

[12 Dec. 2019, Hong Kong] – Assured Asset Management (“Assured”), a Hong Kong-based technology-driven asset manager, has launched its Traceable Accounts Payable (“TAP”) platform with the Shui On Group. TAP is a blockchain-based digital payment system backed by approved supplier account receivables and contract payables issued by anchor enterprises. The partnership aims to leverage TAP to illuminate transaction flows deep within Shui On’s construction supply chain.

Consumer Sector, the Hero of the US Economy in 2019

Last month, the Fed had announced the benchmark rate cut for the third time this year to prevent the economy to fall due to global weakness and the trade uncertainty. The Fed Fund Rate is currently ranging from 1.5% to 1.75%. Though the record-long US expansion cooled further in the third quarter, the US economic growth still kept up at a solid pace as strong consumer activity partially offset the effects of ongoing trade disputes among the largest economies.

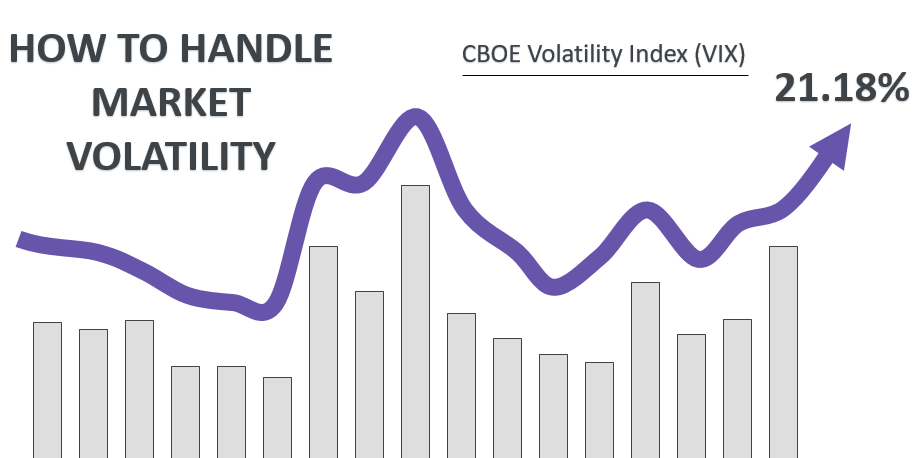

As Traditional Markets Dim, Consumer Credit Shines

The pursuit of attractive investment opportunities has become increasingly tumultuous as political and governmental uncertainties escalate. Following the 2008/9 financial crisis, investors expected central banks to gradually curtail Quantitative Easing (QE), a monetary tool whereby a central bank purchases government bonds to inject liquidity into the economy, and subsequently raise interest rates after the global economy begins to recover.

Brexit and the Decoupling of Two Global Economies

News about Brexit has been all but inescapable. On June 23, 2016, the United Kingdom opened the booths to vote for the referendum to leave the European Union. On March 29, 2017, former UK Prime Minister Theresa May submitted Article 50 as formal notice of UK withdrawal from the EU, beginning a two-year period during which the UK and EU could negotiate withdrawal terms. However, a divided UK parliament rejected Theresa May’s proposal for withdrawal, causing May to resign in June 2019. The EU was left with little choice but to extend the negotiating deadline to October 31, 2019.

Investor Impact Amongst Negative Yield Markets

Recent financial headlines have focused on the impact of Zero Lower Bound and negative interest rates. The Zero Lower Bound signifies that nominal interest rates are at or below zero and that particular investment yields are effectively negative. For investors, this translates to bank deposits and holding bonds to maturity returning less capital than the face amount of the original investment.

Understanding the Risk of US Consumer Credit

There is no secret that consumers play an important role in driving US economy given how close everyone is monitoring US consumer confidence level. As a result, US consumer finance market is at the core of the US economy. The performance of this asset class plays a critical role in US as consumer credit market is growing at a very fast pace.

Why Invest in US Consumer Loans?

Diversification is crucial to a well-balanced optimized portfolio. Many investors typically invest in traditional asset classes such as stocks and bonds; however, alternative asset investment has picked up over the last decade due to its valuable contribution to portfolio diversification.

FinEX Asia Highlighted as Best HK Blockchain Startup

Asia Blockchain Review published an article titled “Hong Kong, a great place for blockchain startups” and highlighted FinEX Asia as one of Hong Kong’s best blockchain startups. With strong governmental support, Hong Kong has become a major blockchain development hub in Asia and has attracted local and international players